How to Beat the Interest and Pay Your Mortgage Off Early

(Plus, some easy ways to find extra savings in your existing household budget)

Kim Sion, Realtor, Sion Real Estate Co. w/ Real Broker, LLC

When you lock in a mortgage, you’re not just paying toward your home—you’re paying for someone else’s cash flow. Most people know their monthly payment, but not how interest accrues daily (per diem) and how small extra payments can dramatically shorten the life of a loan.

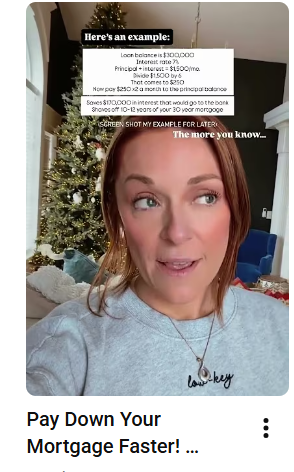

Here’s a real-life, easy-to-understand scenario using your numbers:

Loan amount: $300,000

Interest rate: 7% APR (fixed)

Term: 30 years (360 months)

Standard P&I payment: ~$1,500/month (for simplicity)

Paychecks: 1st & 15th of each month

Goal: Apply an extra $250 each paycheck (so $500/month) straight to principal

(Let me explain how it works, here ⬇️)

Because interest accrues daily, every dollar you apply early reduces the base on which the next day’s interest is calculated. That means paying extra earlier is more effective than waiting until year-end.

What this might look like in practice

Scenario Monthly Payment Extra Principal Estimated Payoff Time* Standard (no extra) $1,500 $0 ~30 years With $250 extra each paycheck $1,500 + $500 $500 ~18–20 years *Approximation only—actual term depends on rate changes, taxes, escrow, etc.

By pushing that extra $250 twice a month to principal, you could shave 10–12 years off your 30-year loan and save tens of thousands in interest.

“Think of every extra payment as a time machine—you’re retreating the finish line, not just making a payment.” — Kim Sion, REALTOR®, Sion Real Estate Co.

Mind blown, right??? Let's see what we can do on your existing mortgage... Cause ain't no one go time for that!

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

Want to try the math on your own mortgage?

Do the math! Below are some compounding interest calculators - Just plug in your situation and see how much you can reduce your mortgage!

(Not all resources are deemed reliable. Readers are encouraged to check with local lenders or even you current mortgage company to assure the payment calculated will achieve your desired result.)

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

CHECK IT OUT

Recommended Calculators & Tools

Investor.gov – Compound Interest Calculator

Use this tool to plug in initial amounts, monthly contributions, and compounding frequency to see how interest grows over time.

Link → Investor.gov Compound Interest Calculator InvestorMoneySmart (Australia) – Compound Interest Calculator

A clear, no-frills calculator that shows how deposits, compounding, and time interact. Useful for showing the compounding impact.

Link → MoneySmart Compound Interest Calculator MoneysmartThe Calculator Site – Compound Interest + Loan Calculator

This one allows you to include regular contributions or extra payments and shows how balances change monthly/yearly. Great for illustrating extra-payment strategies.

Link → The Calculator Site Compound Interest Calculator The Calculator SiteCalculator.net – Interest & Amortization Calculator

More detailed tool that helps you see how much interest you pay, how your balance drops, and how extra payments accelerate payoff.

Link → Calculator.net Interest Calculator Calculator.net

Why this matters

When you only make the minimum payment:

You pay mostly interest in early years, minimal equity builds.

Your home becomes less of a wealth-building tool and more of a long-term liability.

Because you’re borrowing longer, you’re exposed to interest-rate risk, market downturns, job changes, and retirement transitions.

Applying small extra amounts early:

Cuts interest compounding.

Builds equity faster (meaning you own more of the home sooner).

Creates optionality—refinancing, selling, leveraging equity—much earlier in your ownership lifecycle.

Ready for a Bonus?!

Here are some great money saving tips that actually work!

(That Actually Work!)

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

Here are proven tactics to free up money so you can apply it toward your mortgage (and your future).

-

Review your insurance annual or semi-annual.

Cancel duplicate policies, bundle home + auto, pay upfront when you can. Pre-paid premiums often earn discounts. (Source: Consumer Reports on Insurance Savings) -

Audit subscriptions + small recurring spend.

Every month or quarter, scan your bank statement for:-

Multiple video/music subscriptions

-

Food-delivery charges (DoorDash, Grubhub)

-

Impulse purchases (coffee stops, gas station snacks)

Pull out a budget envelope for “on-the-go” spending: once it’s gone, it’s gone.

-

-

Use cash-back credit/debit tools.

Example: Costco Executive Membership yields ~2% cash back on qualifying purchases. Capital One, Chase, etc., offer 1–5% back in categories like groceries, office supplies, home goods. Over time, that adds to principal payment potential. (Source: NerdWallet on Cash-Back Cards and Investopedia on Membership Benefit ROI) -

Meal plan & limit “eaten-out” budget.

If your grocery bill shrank from $1,200/month to ~$800 by planning meals + leftovers, you’ve just freed ~$400/month. That’s nearly as much as your $500/month extra principal payment target in our example. Small changes = big impact. -

Install browser extensions for cash-back and coupon hunting.

Don’t ignore tools like Rakuten, Capital One Shopping, Honey, etc. They notify you when cheaper options exist or give you extra cash for items you’ve already planned to buy. (~$50–$150/year easily.)

Financial discipline is an art, not a whim. It’s not glamorous, but it works.

“The tiny dollar you didn’t swipe on fast food today might be the mortgage payment you will never make ten years from now.” — Kim Sion, REALTOR®

Final thoughts

You don’t need a windfall to win your mortgage. You just need a plan + discipline.

By making small but consistent extra payments, especially at the start of your pay period you’re beating compounding interest and shortening the race. Pair that with smart budget hacks like insurance review, cash-back cards, and meal planning, and you’ve built your own financial engine.

If you’re ready to go from “just paying” to “owning sooner,” we’ve got your back.

— Join our Pretty Profitable Podcast every week for real talk, real strategies, and real results.

— Text “50” to 208-201-9245 to receive market updates, finance alerts, and exclusive homeowner tips.

— In Southeast Idaho and want a trusted team to guide you?

Jed & Kim Sion, REALTORS®

Sion Real Estate Co. – Real Broker, LLC

🌐 www.soldbysion.com

Sources & further reading

-

How much more you pay with longer terms: Better.com – 50-Year Mortgage Impact

-

Income vs home-equity wealth data: NAR & Realtor.com

-

Cash-back card and subscription savings research: NerdWallet, Consumer Reports

Categories

- All Blogs (14)

- 50-year mortgage (2)

- Available Homes in Pocatello, ID (2)

- Best Realtor in Idaho (1)

- Build Your Dream Home (1)

- building a home in Idaho (1)

- Christmas Events in Idaho (1)

- Communities (2)

- Compounding Interest (1)

- Create a home budget (1)

- Downtown Idaho Falls (1)

- Dream Home Finder (2)

- Fall Maintenance (1)

- Find a home in Idaho Falls (1)

- FIrst time Home buyer (2)

- Help me Build a House (1)

- Holiday Events Pocatello (1)

- Holiday Events Utah (1)

- Holiday Parades in Idaho Falls (1)

- Holiday Parades in Pocatello (1)

- Home Improvements (1)

- Home Loan (1)

- Home Lot with a View in Idaho (1)

- Home Lots available (1)

- Home Maintenance (1)

- Home Warranty (1)

- Homes available in Rexburg, Idaho (1)

- Homes for sale in Idaho (1)

- How to Apply for A Home Loan (3)

- How to pay off your mortgage faster (1)

- How to save money (1)

- How to Transfer My Utilities Idaho Falls (1)

- Idaho Falls Real Estate (2)

- Idaho Falls Realtor (1)

- Jed & Kim Sion, Realtors Pocatello (4)

- Kim Sion, Idaho Falls Realtor (4)

- Kim Sion, Realtor in Rexburg (1)

- Lava Hot Springs Realtor (1)

- Living in Idaho Falls (2)

- Lot Available on the Golf Course (1)

- Magical Holiday Events in Utah or Idaho (1)

- New Construction Lots (1)

- Organize Finances (1)

- Places to eat in down town Idaho Falls (1)

- Pocatello Utility Companies (1)

- Pocatello, ID (1)

- Prepping Your Home To Sell (1)

- Realtors in Pocatello, ID (2)

- Rexburg Realtor (1)

- Search Homes in The Highland Area Pocatello, ID (1)

- Selling Southeast Idaho (3)

- Steps to finding my Dream Home (1)

- The Polar Express, Heber City (1)

- Things to do in Downtown Idaho Falls (1)

- Things to do in Idaho Falls (2)

- Things to do in Park City Utah (1)

- Things to do in Pocatello, ID (2)

- Things to do in Rexburg, Idaho (1)

- Things to do in Winter Idaho Falls (1)

- Things to do in winter Pocatello (1)

- TV Host for American Dream Network (1)

- Utility Companies in Southeast Idaho (1)

- Ways to Save Money (1)

- Winterize Your Home in Idaho (1)

Recent Posts

GET MORE INFORMATION